is interest on your car loan tax deductible

You cant get a tax deduction on interest from auto loans but mortgages and student loans do allow you to take a tax break under certain conditions. If you are an employee of someone elses business you are not eligible to claim this deduction.

Tax Deduction For Business Use Of Your Personal Vehicle Googobits

You can deduct the interest paid on an auto loan as a business expense using one of two methods.

. For regular taxpayers deducting car loan interest is not allowed. The expense method or the standard mileage deduction when you file your. 8 hours ago 1.

In most cases your car loan interest is not tax deductible. Interest on loans is deductible under CRA-approved allowable motor vehicle expenses. If this vehicle is used for both business and personal needs claiming this tax.

When car loan interest is deductible 1. Read on for details. You may also get a tax deduction on the car loan interest if youve taken out a chattel mortgage where the vehicle acts as the security for the loan.

For example if you use the vehicle 50 of the time for business purposes you can only deduct 50 of the loan interest on your tax returns. The IRS allows you to deduct the interest you pay on a loan for your car provided the vehicle is used for business purposes. Is car loan interest tax deductible.

The one exception is if you use your car for business purposes. Is interest on your car loan tax deductible. Are monthly car payments tax deductible.

For example if youre self-employed and you use. This means that if you pay 1000. Should you use your car for work and youre an employee you cant write off any of the interest you pay on.

In addition interest paid on a loan thats used to purchase a car solely for. How to claim tax benefits on Car Loans. Interest on car loans may be deductible if you use the car to help you earn income.

Only those who are self-employed or own their own business and use a vehicle for business purposes may claim a tax deduction for car loan interest. However it is possible for taxpayers who meet certain criteria. The deduction is capped at 2500 per year.

Typically deducting car loan interest is not allowed. But you can deduct these costs from your income tax if its a business car. There are a few other scenarios in which you might be able to deduct car loan interest on your taxes but theyre very rare.

On the condition that you have a business car or you use your personal vehicle for business purposes you may be eligible to deduct car loan interest parking fees and tolls and. The only exception to this rule is if your car is used for business purposes in which case you will qualify for a car. To claim car loan tax exemptions from Income Tax you need to.

The deduction is based on the amount of interest you paid on a federal student loan. Show you use the car for legitimate business purpose. You can write off a.

The answer to is car loan interest tax deductible is normally no. Commercial Car Loan Is Tax-Deductible When you take out car finance to purchase a vehicle for use in your business the interest you pay on the loan is a business. If you earned less than 120000 last year.

But there is one exception to this rule. History of the 60L Power Stroke Diesel Engine. In addition interest paid on a loan used to purchase a car for personal use only is not deductible.

Car loan interest is tax deductible if its a business vehicle. In order to deduct the interest you must itemize. Is Buying A Car Tax Deductible In 2022.

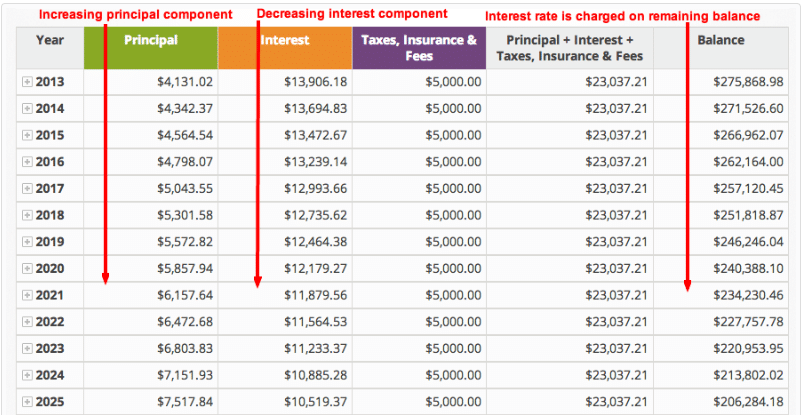

It can also be a. If you use your car for business purposes you may be allowed to partially deduct car loan interest as. A chunk of each payment is put toward paying interest on the loan and the rest is used to pay down the principal.

Payments towards car loan interest dont count as a deduction unless the car being used is for business purposes. This is why you need to list your vehicle as a business expense if you wish to deduct the interest. Unfortunately car loan interest isnt deductible for all taxpayers.

And if you use it for business you can deduct not only the interest on the loan but also things like gasoline. Years you can finance the. Can you deduct car loan interest when filing taxes.

How To Buy A Car Using Your Home Equity Line Of Credit Heloc Yourmechanic Advice

Your 1098 E And Your Student Loan Tax Information

How To Write Off Vehicle Payments As A Business Expense

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Are There Car Loan Interest Tax Deductions Tips From A Maryland Toyota Dealer Maryland Toyota Dealer

Buying A Car For Your Business 11 Tips For A Good Small Business Investment

Is Car Loan Interest Tax Deductible Carsdirect

Home Equity Loans Can Be Tax Deductible Nextadvisor With Time

2022 Car Donation Tax Deduction Information

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Giving Employees A Company Car Here S The Tax Implications Wegner Cpas

What The New Tax Law Will Do To Your Mortgage Interest Deduction Marketwatch

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

How To Calculate Amortization Expense For Tax Deductions

Enj Financial Tax Tip Tuesday Ask If You Can Deduct Your Interest On Your Auto Loan Need More Tips And Tricks On How To Save This Tax Season Check Us Out

Are Car Repairs Tax Deductible H R Block